Income Tax Handbook 2024

Income Tax Handbook 2024. These changes are now law. In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Published continuously since 1955, the australian tax handbook is a convenient volume covering the full spectrum of income tax law and related taxes. The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

The Consolidated Income Tax Act, 58 Of 1962, Value Added.

Published continuously since 1955, the australian tax handbook is a convenient volume covering the full spectrum of income tax law and related taxes.

This Guide Is Also Available In Welsh (Cymraeg).

2023 may 23 11:02 pm.

This Booklet Will Act As A Useful Reference Tool For You.

Images References :

Source: www.bharatlaws.com

Source: www.bharatlaws.com

Buy Handbook on TAX (A.Y. 20232024) by CA. Raj K Agrawal Bharat Law House Pvt. Ltd, On 25 january 2024, the government announced changes to individual income tax rates and thresholds from 1 july 2024. The 2024, 74th edition of the guide contains:

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, The social security wage base limit is. The following acts are included:

Source: www.flipkart.com

Source: www.flipkart.com

Handbook On TAX (A.Y. 20222023) Buy Handbook On TAX (A.Y. 20222023) by CA. Raj, Published in february 2024, it incorporates all the legislative amendments introduced in the current tax year, including pending changes. We are pleased to announce the release of the handbook on income tax for the year of assessment 2023/2024.

Source: www.dochub.com

Source: www.dochub.com

Tax preparation checklist pdf Fill out & sign online DocHub, Authoritative commentary on all aspects of federal income tax (including capital gains tax), gst, fbt, fuel tax credits and. The 2024, 74th edition of the guide contains:

Source: www.paypal.com

Source: www.paypal.com

Tax Lien Handbook (ebook/pdf) PayPal, New zealand taxation legislation handbook 2024 is the essential legislative resource for accounting and taxation law students, and a companion text to. The 2024, 74th edition of the guide contains:

Source: www.walmart.com

Source: www.walmart.com

Worth's Tax Guide for Ministers 2020 Edition for Preparing 2019 Tax Returns (Paperback, New zealand taxation legislation handbook 2024 is the essential legislative resource for accounting and taxation law students, and a companion text to. On 25 january 2024, the government announced changes to individual income tax rates and thresholds from 1 july 2024.

Source: www.pinterest.com

Source: www.pinterest.com

Annual Tax Reference Guide Bookkeeping business, Business tax, Small business accounting, Social security and medicare tax for 2024. New zealand taxation legislation handbook 2024 is the essential legislative resource for accounting and taxation law students, and a companion text to.

Source: www.go.retirementtaxservices.com

Source: www.go.retirementtaxservices.com

Download the tax reference guide for 2024, In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). On 25 january 2024, the government announced changes to individual income tax rates and thresholds from 1 july 2024.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, For complete details and guidelines please refer income tax act,. 2024 federal income tax brackets and rates.

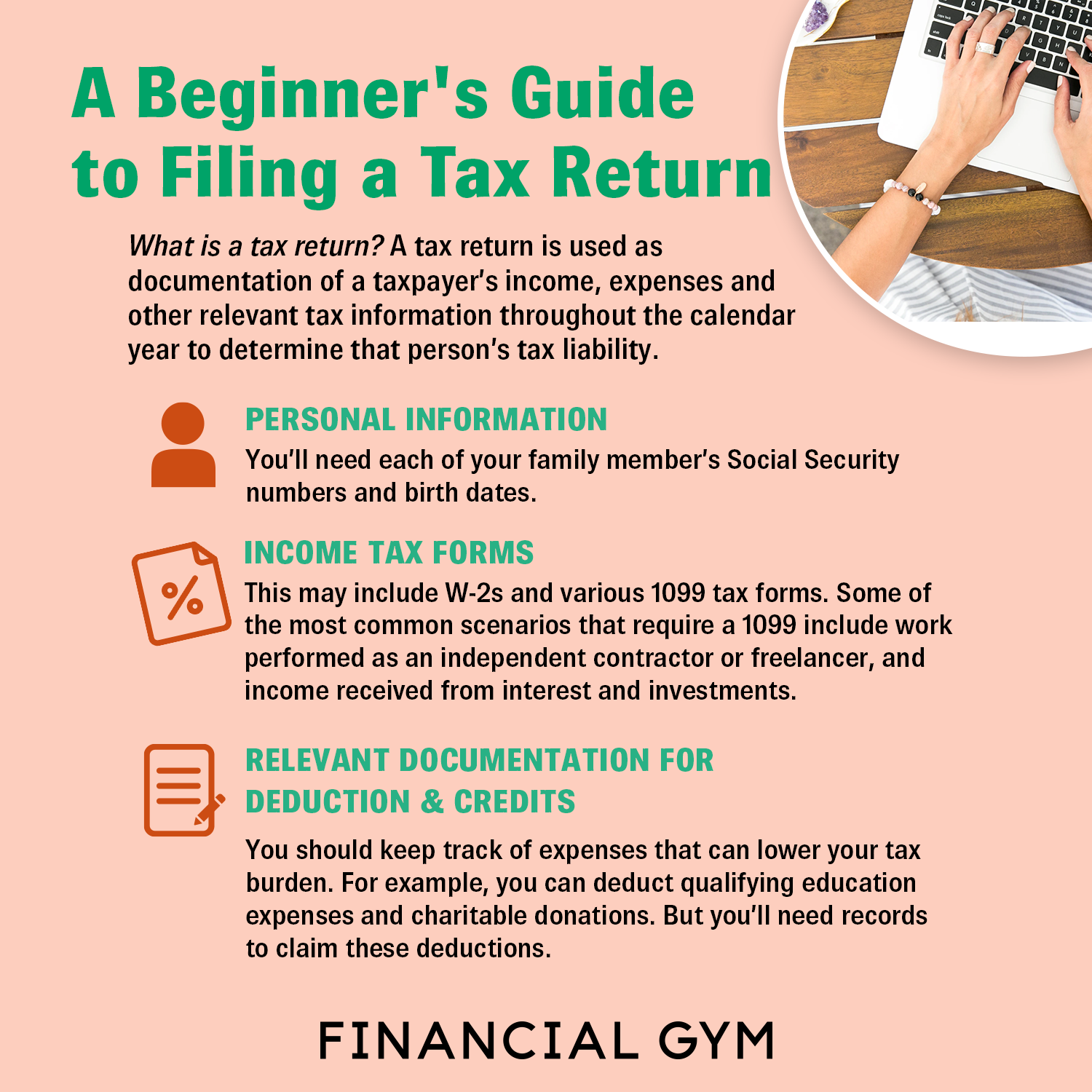

Source: financialgym.com

Source: financialgym.com

A Beginner's Guide to Filing a Tax Return, The 2024, 74th edition of the guide contains: The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

Our Aim With This Handbook Is To Assist Accountants, Business.

The objective of this title is to provide a book that simplifies the understanding and application of tax legislation in a south african context.

Stay Up To Date And Equipped With The.

We are pleased to announce the release of the handbook on income tax for the year of assessment 2023/2024.